- BEST ACCOUNTING SOFTWARE FOR SMALL BUSINESS WITH PAYROLL SOFTWARE

- BEST ACCOUNTING SOFTWARE FOR SMALL BUSINESS WITH PAYROLL FREE

This can include general information, salary data, tax and payment information, and so on.

BEST ACCOUNTING SOFTWARE FOR SMALL BUSINESS WITH PAYROLL SOFTWARE

Your business payroll software should allow you to rapidly enroll people on the payroll, providing you with complete employee profile information in one spot. Simplified employee onboardingĮvery day as a human resources professional, you are inundated with paperwork. Small Business Payroll Software Features #1. Collaborate securely with staff, show the same interface, but limit payroll staff to only what they need to see based on their jobs. You may distinguish between the many responsibilities that each department plays and prevent unwanted access. Payroll software with fine-grained access controls can improve the integrity of your payroll data. The payroll system houses sensitive information about your employees such as salaries, taxes, bank accounts, and so on. Payroll software that is tightly connected with HR and accounting platforms allows you to consolidate three distinct but critical departments under one roof. Secure integrations enable you to access data from many teams in a single location. The procedure is complex and time-consuming, and with a growing firm, it will only become more difficult. Keeping track of payroll expensesĮvery month, payroll employees work with several teams to obtain input for payroll processing. Good payroll software keeps the process orderly, simple, and efficient, from preparing payroll through closing off the pay period in your businesses. Payroll software can automate both complex and simple activities, allowing you to better manage payroll in your business. When you do payroll manually, you leave the door open for unintentional errors that can be very costly.

BEST ACCOUNTING SOFTWARE FOR SMALL BUSINESS WITH PAYROLL FREE

Dedicated payroll software assists payroll specialists in streamlining other payroll duties, allowing HRs and small businesses owners to free up time for critical business projects.

It becomes complex, time-consuming, and occasionally erroneous when done manually, using an antiquated system, or through a spreadsheet. Payroll processing and management entail a wide range of actions to protect a business’s most valuable asset – its people. Importance of Payroll Software for your Small Business Payroll software allows professionals to easily keep track of all of these tasks from one location. Every month, a succession of repetitious duties are performed, ranging from registering employees on the company’s payroll to guaranteeing flawless compliance and maintaining payroll records till exit. Payroll Software DefinitionĪny HR or payroll expert will tell you that payroll processing entails more than just calculating paychecks. In addition, we have a review of 5 free payroll software for small businesses.

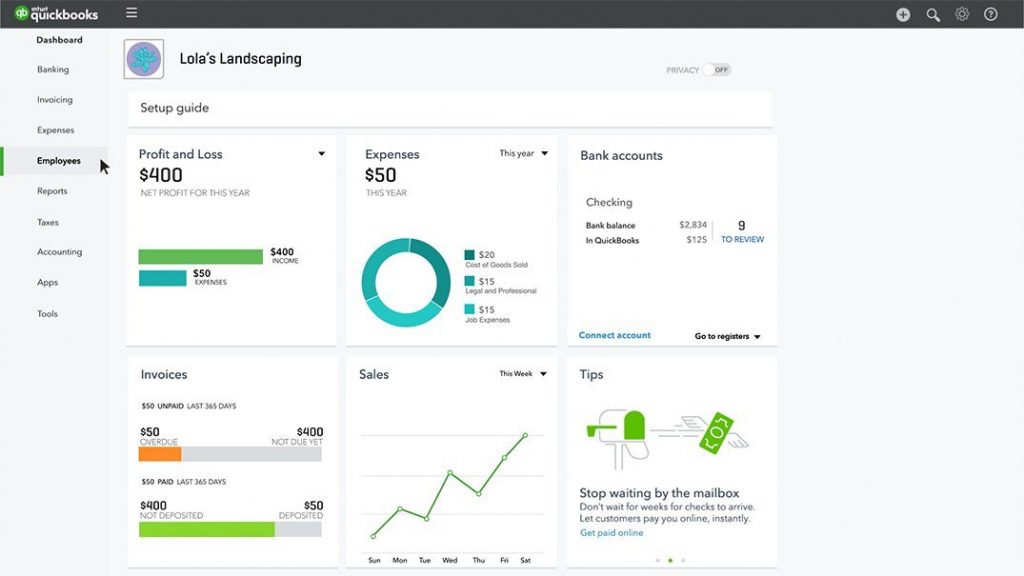

Here are some of the most significant payroll software features, perks, and factors to consider when selecting the finest payroll software for your small business. Payroll software is a system used by human resources (HR) or payroll professionals to manage the whole life cycle of payroll activities from start to finish. What is the easiest way to do payroll for a small business?.Is QuickBooks worth it for small business?.Can I do my own payroll for my small business?.Payroll Software for small business FAQS.5 Best Free Payroll Software for Small Businesses.

Integration with pertinent business applications

0 kommentar(er)

0 kommentar(er)